FoxyCredit is one of the leading platforms in the market where you can compare loan terms, amounts, interest rates, check out must-have documents, and the requirements of microfinance organizations in your country.

Our platform is developed to provide the outstanding service of consumer credit loan comparison. Here, you can find a list of consumer credit lending companies and compare the offers they provide to their customers. Depending on the interest rate, maximum amount, and various other factors, you can choose the best option for you.

* The consumer loan is a loan to one or more individuals for household, family, or other personal expenditures. Home mortgage, small business, or a small farm loan is not considered as a consumer loan.

With the different types of loans available to consumers, this specific type of loan allows people to get household goods, devices, and various other appliances. Personal consumer loans are mainly provided to individuals for their personal expenditures, which should not include mortgages, business, or similar kinds of purposes. According to recent studies, the most common consumer loan approvals were for buying household goods.

That is why the number of consumer loans in the world has increased by 3% in the period of 2019-2022. This kind of change has shown that many people want to find the best consumer loan companies that will confirm their requests by comparing consumer loans available in the market. Many people have a knowledge gap in this area, so they feel a dire need for expert opinion and proven analytics to help them make a profitable choice. This is where our professionals can come in handy.

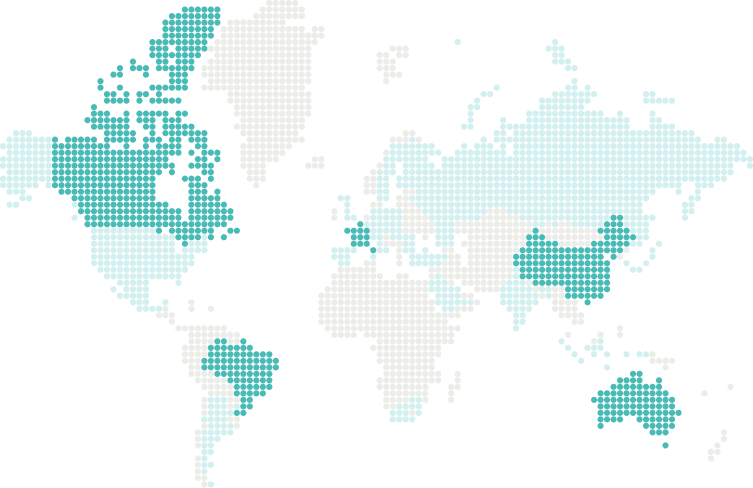

The increase in the interest for consumer loans has been noticeable in many countries. However, the top 5 countries that have shown dramatic growth in consumer lending requests in the G20 countries are Australia, Brazil, Canada, China, and France. As of the results of Q2, these countries have shown a large increase in interest in different types of consumer loans, which leads to an increase in consumer loan rates as well. According to recent studies, in the Eurozone only, the consumer loan interest rate has increased from 1.72 to 1.78 from the previous year. Nevertheless, the number of consumer proposal loans has not decreased since the beginning of 2022.

Australia

Brazil

Canada

China

France

We operate in nine countries including Denmark, Norway, Sweden, Finland, Poland, Romania, Lithuania, Estonia, Ukraine.

Mention the loan amount and the period during which you will manage to pay the debt. Get the most compatible options based on your criteria.

We pick the top companies that are most likely to accept your request. All you need to do is to check the list and choose the best fit.

We use modern tech solutions and regularly check out the relevance of data. Our objective and award-winning team of 20+ people monitors existing and new microfinance organizations. With the help of our quick calculator, you can check which banks and lenders have the best loan offers. Once you indicate the amount and the term, our flexible system will sort out the best options right across the market. With only a few simple steps, you can find the best offer for you, avoiding all the excessive and confusing data.

| Money | 10000 $ |

| Term | 186 days |

| Method of obtaining | on cards |

| Rate | 1.2% |

Recent studies have shown the statistics of our users. 52% of our users are male, and 48% are female. Although the difference is not that much, based on the gathered information, people who use our comparison platform are mostly males in their mid-30s. The surveys show that people who use our service mainly require consumer loans for various personal purposes, including traveling, shopping, and personal expenses.

There are various types of consumer loans in the market. However, some of the most common ones that people mainly request from the lending companies are:

loans provided for students to pay for their education: tuition, housing, and other educational expenses.

loans for buying cars or trucks.

loans with lower interest rates for individuals who have an existing loan and want to refinance it.

a long term loan for buying a new house.

a loan to individuals who want to open or expand their business.

loans for personal expenditure of day-to-day expenses, such as household purchases, debt consolidation, vacation planning.

There are many lending companies on our platform, where you can compare all the details and choose the best option for your loan requests. Comparing the packages that the companies offer are very easy with Foxy Credit. Some of the most demanded companies on our platform include:

Ferratum group is one of the leading lending companies founded in 2005. Various small businesses are included in the group, including Ferratum Oyj. The head office of the company is located in Helsinki. Ever since its foundation, Ferratum group has managed to expand its chains in many European countries, North and South Americas, and Asia Pacific areas.

Another leading lending company is Thorn, the head office of which is located in New Zealand, Auckland. Having been founded in 1962, the company delivered financial services to its customers, including consumer loans. This financial institution has many chains in various countries, delivering loans for people who are in need of such.